Key takeaways:

U.S Economy

Inflation data reveals both CPI and PCE acceleration in January, posing a potential delay in the Fed's interest rate cuts.

S&P Global's early February PMI estimates reveal a slight expansion in business activity, with the service sector cooling slightly (51.3) and manufacturing experiencing a notable upturn (51.5).

A decline in consumer confidence and sluggish spending on durables signal uncertainty about the U.S. economy and consumption. However, more data points are needed to ascertain whether the consumer is weakening.

The data on "weekly jobless claims" reinforces the robust job report from January, highlighting the historically tight conditions in the US labor market.

The market expects little chance of the Fed lowering benchmark interest rates in the March FOMC Meeting

European Economy

According to the HCOB Flash Eurozone Composite PMI Output Index, the Eurozone's economic downturn showed signs of moderation in February as the service sector stabilized, resulting in the smallest contraction in overall output since June.

Germany and France are experiencing declines, but the rest of the eurozone is seeing expansion for a second consecutive month.

The UK experienced an acceleration in economic expansion in February, marked by the fastest increase in business activity in 9 months, with the seasonally adjusted S&P Global UK Composite Output Index rising from 52.9 in January to 53.3.

U.S Macro Overview

Key economic indicators

January inflation acceleration castes doubt on Fed's rate cut plans

Figure 1: Inflation measures of the U.S (Source: FRED data retrieved from U.S. Bureau of Labor Statistics)

The Federal Reserve's preferred inflation measure, the January core personal consumption expenditures (PCE) price index, excluding food and energy costs, increased by 0.4% from December. Additionally, the headline PCE, including food and energy, increased by 0.3% monthly and 2.4% annually.

Thursday's data on the PCE price index met expectations, with no significant deviations. However, the strong core PCE prices posed a challenge for the Federal Reserve, which aims to stabilize inflation at 2%.

The PCE data also aligns with January's consumer price index (CPI), indicating a rise in the cost of goods and services. Both January pricing data reports make February's data crucial in determining whether January's trends were temporary or indicative of a more sustained pattern.

Earlier, Consumer Price Index (CPI) inflation reported a y-o-y growth rate of 3.1% in January, slightly lower than December's 3.4% and the expected 2.9%. The hotter-than-expected CPI suggests persistent inflation, primarily driven by an uptick in shelter costs.

For more details of the CPI January reading, please refer to: Morningstar - January U.S. CPI Report

S&P Global Flash PMIs in February: Manufacturing Surged, Services Sector Cooled

Figure 2: S&P Global Flash US PMI (Source: S&P Global PMI US Releases)

S&P Global's early estimates for February purchasing managers’ indexes (PMIs) reveal a marginal decline in the composite output index, dropping from 52.0 to 51.4, indicating a modest expansion in business activity.

While the service sector growth cooled slightly with the Flash US Service Business Activity PMI falling to 51.3 from 52.5 in January, the manufacturing sector experienced a welcome return to growth. The Flash US Manufacturing PMI rose to 51.5, marking the sharpest upturn in the sector in 17 months, largely driven by increased export orders."

Consumer confidence dips and sluggish spending on durable orders

Figure 3: Consumer Confidence Index in the U.S (Source: The Conference Board)

The Conference Board's Consumer Confidence Index (CCI), released on Wednesday 28/2, unexpectedly declined to 106.7 in February from a downwardly revised 110.9 in January, breaking a three-month streak of gains. The drop is attributed to "persistent uncertainty about the U.S. economy," according to Dana Peterson, chief economist at The Conference Board.

Figure 4: U.S Durable Goods Orders (Source: tradingeconomics)

Additionally, on Tuesday 27/2, January Durable Orders experienced a larger-than-expected decline of 6.1%, down from a revised –0.3% in December. Excluding transportation, orders also dropped 0.3%, with analysts predicting a 4.4% decrease in new orders for January. This report points to sluggish spending on durables.

However, more data points are needed to see whether the consumer is weakening.

Job market

The U.S labor market remained tight

Figure 5: Initial jobless claims in the U.S (Source: tradingeconomics)

In the week ending February 24th, the number of individuals claiming unemployment benefits in the US (Initial jobless claims) increased to 215,000, marking a rise of 13,000 from the revised level of the preceding week. Despite this uptick, weekly claims continue to reflect a consistently low level of job-cutting.

Currently, around 1.9 million workers are claiming unemployment benefits (Continuing jobless claims), indicating a slowdown in hiring by employers. However, the data suggests that active worker layoffs are not widespread.

Market expectations and Fed policy

The market expects little chance of the Fed lowering benchmark interest rates in the March FOMC Meeting

Figure 6: Market expectations on Fed fund rate in March FOMC meeting (Source: CME FedWatch Tool)

Investors persisted in perceiving a minimal likelihood of the Federal Reserve reducing benchmark interest rates shortly. As of Wednesday 28 February, traders assessed a 97.5% probability that the fed funds target would stay steady within the range of 5.25%-5.5% after the March 19-20 Federal Open Market Committee (FOMC) meeting.

Europe Macro Overview

Eurozone

Eurozone downturn moderates thanks to the recovery in the service sector

Figure 7: Eurozone PMI output by sector (Source: S&P Global)

The HCOB Flash Eurozone Composite PMI Output Index, compiled by S&P Global, increased from 47.9 in January to 48.9 in February, indicating the ninth consecutive month of declining output, but with the smallest contraction since June.

Manufacturing output declined for the eleventh consecutive month, while the service sector stabilized in February, signaling only a marginal drop in demand.

Figure 8: Eurozone PMI output by region (Source: S&P Global)

Meanwhile, Germany and France experienced economic output declines, but the rest of the eurozone saw expansion for a second consecutive month.

UK

UK PMI experiences faster growth, reducing recession pressures

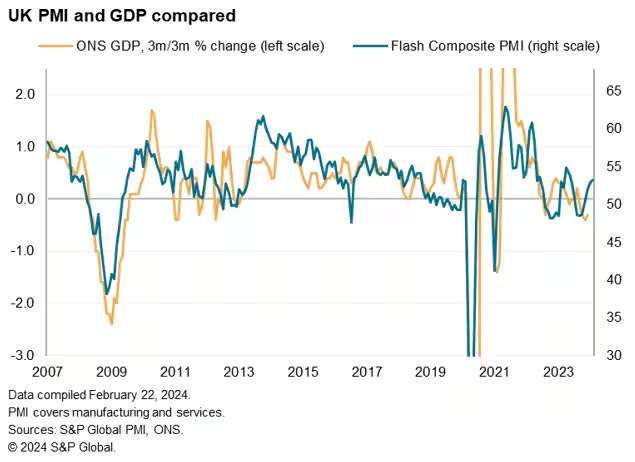

Figure 9: U.K PMI and GDP (Source: S&P Global)

Economic expansion in the UK gained momentum in February, as early PMI survey data revealed the fastest increase in business activity in nine months. The seasonally adjusted S&P Global UK Composite Output Index climbed from 52.9 in January to 53.3 in February.

The current PMI suggests a quarterly GDP growth rate of just under 0.3%, based on historical comparisons, projecting a growth of slightly over 0.2% for the first quarter.

Economic Calendar

Figure 10: Economic Calendar Next Week (Mar 4 - Mar 9) (Source: CryptoCraft)

Some upcoming key economic indicators for next week:

Wed Mar 6: U.S JOLTS Job Openings and ADP Non-farm Employment Change

Thu Mar 7: EZ Monetary Policy Statement

Fri Mar 8: U.S Average Hourly Earnings m/m and Unemployment rate